Despite Amazon’s rise to a $11.2 billion profit in 2018, the corporate giant will not have to pay a dime in federal income taxes. Not only that, but they were essentially paid $128 million by the government via rebates due from the 2017-2018 fiscal year. A combination of factors contributed to this, such as corporate tax rate cuts and stock compensation from the company’s early days. The fact that the company who generates money for the richest man in the world doesn’t pay any federal income tax is absurd. Even politicians on opposite ends of the spectrum seem to agree, as both Senator Bernie Sanders and Donald Trump have condemned the lack of taxation on the shipping conglomerate.

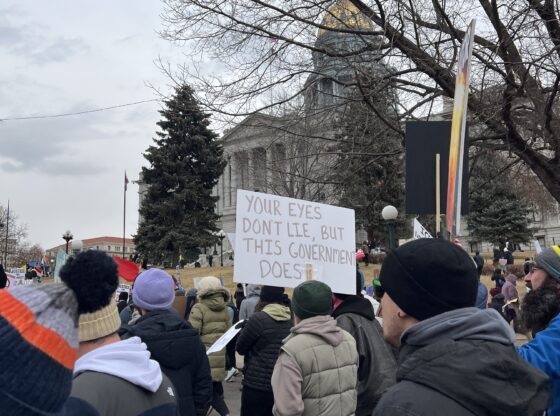

The Institute on Taxation and Economic Policy reported that the absence of Amazon’s tax payments are largely due to the massive corporate tax cuts that Donald Trump’s administration proposed. The hypocrisy behind this situation ought to be upsetting to every American, as those very cuts are expected to make the U.S.’s debt even higher, to the tune of a $3.2 trillion loss in tax revenue over the next ten years. Cutting taxes for the powerful and allowing those who lean on the results of those taxes to flounder should raise moral questions. America obviously has an issue regarding who deserves higher taxation and who deserves exemptions from it.

Though Amazon did pay about $900 million in taxes to state governments and the rest of the world, it didn’t owe anything federally due to “deductions for stock-based compensation and assets that are depreciating in value,” according to France24. However, no business valued at almost a trillion dollars should be exempt from payments that would benefit America’s national programs. For Amazon to start paying taxes, American tax law would have to actually be changed, since everything Amazon has done to avoid paying taxes is perfectly legal. The U.S. government hasn’t closed any loopholes, despite it being perfectly feasible to do so, and the money garnered from Amazon’s hypothetical taxation could have benefitted community development, veterans’ programs and more. For the government to allow such a large corporation to continuously get off scot-free is shameful in and of itself, as it lets the already grossly rich become even wealthier while those who need government programs continue to rely on them. Considering Trump has already taken funding away from programs that millions of low-income families depend upon, this blow is practically insulting to the American people.

Amazon itself is not at fault here, as they did technically pay all of the taxes they were required to pay, but they aren’t the only ones who’ve reported net tax gains instead of losses. Corporations such as Goldman Sachs, Southwest Airlines and General Motors have logged benefits in recent years, as well. Businesses worth as much as around $70 billion should be contributing more to the national programs that they ought to be. It’s time for the reverse-Robin Hood strategy the U.S. government has been operating under to come to a close.