Writing letters, counting and learning social development: each of these skills plays a role in preschool education, as well as kindergarten readiness. Across Colorado, 60% of four-year-olds are enrolled in preschool as of Sept. 2023, according to the Colorado Department of Early Childhood.

In 2020, Colorado voters approved Proposition EE, a tax on tobacco products to fund pre-k programs. At the time, policymakers estimated that the state would collect $186.5 million from the measure; instead, the tax raised $205 million. Now, Coloradans will vote again to decide whether the state can keep the excess to put towards pre-k or if the funds should return to tobacco sellers.

In 1992, Colorado voters approved the TABOR laws, which require the state to ask voters before increasing taxes or spending excess tax revenue. After Proposition EE passed in 2020, the taxes on tobacco and nicotine products have exceeded what voters originally approved. This means the state government must ask voters to approve the difference to spend the excess revenue on preschool programs.

Voting “yes” will result in this money being spent on pre-k programs and the current tobacco and nicotine product tax remaining the same, while a “no” vote will give the excess tax money back to the tobacco wholesalers and distributors and reduce taxes to avoid excess revenue in the future.

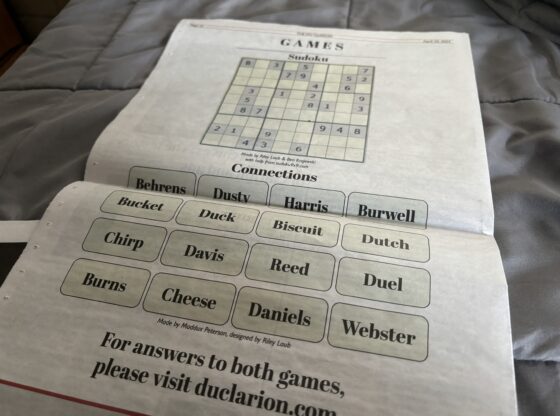

The Clarion conducted a survey via Instagram asking students their opinions on Proposition II. 36% were in favor, 5% were against, 55% had never heard of Proposition II, and 5% had no opinion in a sample of 22 respondents.

For many Colorado families, the price of preschool can be too much. In July, Colorado became the fifth most expensive state for childcare, with the Denver Preschool Program estimating the cost of preschool in Denver to be about 20-40% of a family’s income.

“We’re averaging it at about $12,000 a year but there are some providers that are up to $18,000 a year,” said Irene Bonham, Director of Communications and Outreach of the Denver Preschool Program. “That rivals in-state tuition for college.”

Early education impacts a child’s development long after preschool.

“Children who attend early education programs … have stronger early language development [and] literacy and math skills,” Bonham said. “[Students] have a higher likelihood of graduating high school [and] a higher likelihood of attending college. They have a higher likelihood of succeeding in their careers.”

DU first-year Scott Shopneck was in favor of the ballot measure, arguing that Proposition II may be more agreeable to some voters than other measures proposed on the ballot.

“Lots of funding increases are based around income and property tax [raises],” Shopneck said. “Nobody wants to support the tax increases to fund schools, so I think the tobacco tax is a great way to uncontroversially fund schools.”

According to the 2023 State Ballot Information Booklet, arguments against Proposition II assert that the proposition will allow taxes on tobacco products to stay the same, keeping the amount of excess revenue generated the same. There is no formal opposition, but the State Ballot Information Booklet says by imposing taxes on people addicted to cigarettes, tobacco and nicotine products, the measure would cause more financial stress.

“I believe Colorado already has enough tax dollars. If they’re trying to passively paint tobacco and nicotine products negatively, instead of investing [the tax money] into preschoolers, invest it into actively educating older students about the consequences these products bring,” second-year Elee Vigil said. “If the state collects more revenue than voters approved, I think taxpayers should be provided refunds and lower rates opposed to expanding government programs.”