The Denver housing market is piping hot. Median single-family home prices have reached $580,000—a new high for the Denver metro area. The asking rates are more overpriced than any other city in the country.

At the end of April 2021, households in the Denver-Aurora area spent an average of 15 days on the market. In April 2020, the average was 34 days. In Denver alone, there are less than 2,000 houses for sale.

This type of real estate market is not sustainable, and it is diminishing affordable housing which inherently pushes out lower-income families and alters the structure of neighborhoods.

The market is fueled by low interest rates. National interest rates for a 30-year fixed-rate mortgage typically range from 3.13% to 7.84%. In Colorado, it is approximately 3.13%. For those who can afford to buy a home, now is an incredible time to secure one at a low rate.

The influx of out-of-staters has only fast-tracked this frenzy. There are a plethora of people from the west and east coasts migrating to Colorado. In both of those locations, the cost of living is distinctly higher. When wealthy New Yorkers and Californians move to Colorado, the housing prices appear reasonable.

This is paired with an increase in housing demand and a decrease in supply. There are simply not enough houses on the market to accommodate all of the buyers. Anyone living in Colorado can drive around and see apartment and household construction taking place everywhere. The state is struggling to build enough houses within a condensed time frame.

However, gentrification is rampant. Denver is the second-most gentrified city in the nation. As housing prices continue to rise, lower-income families of color cannot compete. For instance, a family that can afford a $300,000 house may bid on a $250,000 one because they know they can ask for above the listing price. Yet, this knocks those who can afford a $250,000 house out of the running. In turn, neighborhoods continue to push the poor out of the area.

It is an even more troublesome scenario for people who rent. Since leases are typically temporary contracts, the landlord has the ability to change rental rates. The average rent for an apartment in Denver is $1,661.

This perpetuates housing inequality, but the housing crisis is a multifaceted issue that is difficult to address. One concept, adopted in Minnesota, approved tax breaks for property owners that keep one-fifth of their building units affordable for lower-income tenants over a 10-year-period.

Additionally, there is a cap on how much can be charged for a residence that is based on the individual’s income. For those who are making 60% less than the area’s median income, there is a maximum amount landlords can charge for a studio, a one-bedroom and a two-bedroom.

Another concept is to partner with big tech. Microsoft launched a $500 million affordable housing initiative. It gives loans to developers for reshaping the housing market in their region. There are other ideas out there too, such as revitalizing neighborhoods (i.e., flipping an abandoned building) and relaxing zoning and regulation requirements.

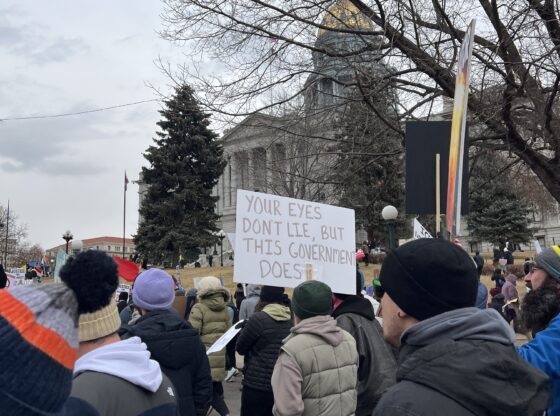

It is challenging to predict when the housing market will slow down. But cities must begin to implement housing regulation strategies, such as the ones outlined previously. Legislators must take a moment to combat these rising prices, so lower-income folks of color are not stripped of opportunities to access affordable housing.