On March 6, a group of tech and art enthusiasts known as Burnt Banksy set fire to an original Banksy print entitled “Morons.” The next day, they sold the print for three times its value of the previous day, the final sale coming to $382,000.

This was not the characteristic Banksy tomfoolery or deception, nor did they collect the ashes of the former print and exchange them for cash.

The truth is that the slow burn of the print, which can now be found on YouTube, was to represent the abstract transfer of authenticity and henceforth value to the digitized version of the work. Now the print exists solely as a non-fungible token or an NFT. The subsequent appreciation of its value can only be explained upon understanding the current hype of the digitized marketplace.

Funnily enough for non-believers, the print’s text read, “I can’t believe you morons actually buy this shit.”

Blockchain

To understand NFTs, a basic grasp of the evolving technology known as blockchain is essential.

Blockchain is a way to store information. However, key differences separate blockchain from your everyday database. One key facet is blockchain’s chronological solidity. Information in a blockchain is compiled into groups, otherwise known as blocks, and chained together so that the predating data is locked in place and creates a timeline of data.

Added to this is blockchains decentralized storage structure, which relies on a network of collective accountability to maintain the data’s accuracy. Once data is compiled into blocks and chained together, it is transmitted to any computers on the server wherever they are located. To change the database’s construction on one computer would be to override the entire network, making any attempted hack an arduous and expensive endeavor.

Other than its security advantages, blockchain’s structure is uniquely poised to document transaction histories, as it does with Bitcoin and other cryptocurrencies. Every exchange is time-stamped, appended to the chain and broadcast across the network—creating a public, verifiable ledger where anyone can view how much crypto is owned and by whom.

Similarly, blockchain is used to track the transaction of NFTs, which are comparable to proofs of ownership in the digital sphere. The difference between bitcoin and NFTs, however, is the distinction of fungibility.

Cryptocurrency is fungible, or interchangeable, in the sense that one bitcoin can be exchanged for another. Both carry the same value, just as the US dollar does, and can be traded accordingly. NFTs by nature are non-fungible, meaning that there is not a one-to-one equivalency in the same way there is with Bitcoin. Only one NFT of a specific kind can be owned by any one person, in some cases rare-ifying the tokens so that their value skyrockets as in the case of the “Morons” print.

These types of tokens have widespread potential and are already popular in the gaming, sports and digital art industries as a way to trade ownership of unique items. But new possibilities are still being explored in the music and healthcare industries, and even inspiring a potentially novel voting system.

The market is reminiscent of an elementary-school economy where children could trade Silly Bandz or Pokémon cards based on collectability. A recent partnership between NFTs and the NBA has furthered the similarity by allowing fans to buy and sell tokenized highlights as if they were sports cards.

The recent buzz that has dominated this past week’s headlines has come mostly from a new domain fittingly called crypto art. This, coupled with the NBA partnership, has made NFTs the most recent pandemic obsession. Once trapped inside for long enough, what else is there to do but burn a six-figure artwork to fulfill a non-fungible dream?

For many, the current hubbub has brought NFTs to the limelight for the first time. But blockchain has been utilized in the digital art world for much longer. Ironically, it all began with Pepe the Frog.

NFTs and digital art

Blockchain began to gain traction in the trading card game industry as early as 2014. Video game studio Everdreamsoft developed the game Spells of Genesis with the intention that in-game assets would be traded using the technology. In 2016, a user named Mike created Rarepepe cards for purchase. By doing this, he unwittingly removed the underlying motivations of the game and effectively created the first memeified art to be traded using blockchain.

Fast forward to the present day, and meme culture is still heavily influential on the NFT market. The Nyan Cat gif found a buyer at nearly $580,000; AI-designed pixelated characters known as CryptoPunks go for millions. Beeple, a prominent digital artist well known in the NFT community, sold his “Everydays—The First 5000 Days” mosaic for a whopping $69 million on March 11.

As many flock to the fanatical pull of NFTs, there seem to be two camps with diverging visions for the future of the virtual art world. When it comes to blockchain and crypto, many are prone to being swept away by the hype. The question of whether recent events indicate the change of art as we have known it or is only a passing fad is subject to the public’s fickle eye.

The answer is likely a mix of both.

The first of these types of thinkers would propose that, for better or for worse, physical art is at its end. They envision the slow shutdown of in-person museums as viewership transfers to virtual horizons. This can be likened to the recent depopularization of movie theatres brought on, but not initiated, by the pandemic. They perhaps fear the apocalyptic destruction of priceless art, as in the case of Banksy Burns. Things are not so extreme.

Realistically, NFTs are simply a modern-day addition to the ever-growing variety of art media. Just as a medium like photography did not bring painting to an end, digital art will not disrupt another art form’s domain. Still, the overly sensationalist attitude that currently grips the NFT market pushes the price of tokens higher regardless of their content. It creates a bubble, and bubbles must pop at some point.

At this point, the NFT market is budding and speculative. For a nascent market, it is exciting to see so much money moving around, but it could prove harmful. Especially since NFTs only serve to prove ownership, and they do not currently prohibit any person with a computer from viewing the art online. Of course, this is nothing new—paintings have been displayed in museums for eons. But those paintings and sculptures held an impressive price tag because they were deemed objectively artistic, which is harder to justify to the tune of millions for computer-generated CryptoPunks that are no more than a few pixels.

Without falling too far down the rabbit-hole of what can and cannot be considered art, it is clear that NFT buyers are less concerned with content and more occupied with capitalizing off the current hype and making a quick buck. Once the hype dies down, one can expect prices to settle. The digital art trade will begin to mirror something similar to the current art trade, albeit with some persistent differences given that anyone can exhibit the downloadable artwork.

However, before the dust has settled, many are already pointing out the largest concern for NFTs and blockchain as a whole.

The environmental concern

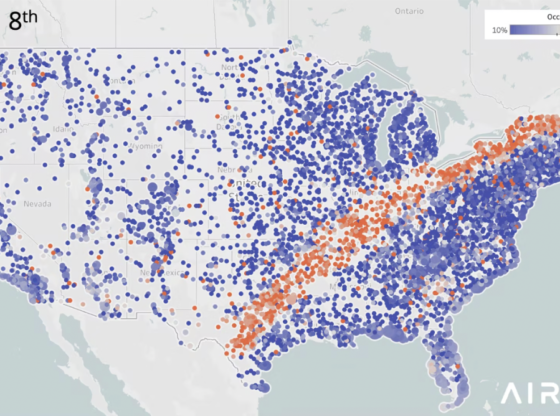

Blockchain’s notorious decentralization may give impressions otherwise, but the immense computing power that goes into solving complex problems within the system, or “mining,” uses an inordinate amount of energy. In terms of energy usage, Bitcoin sits comfortably between Argentina and Ukraine, and that only accounts for a portion of blockchain. Blockchains like Ethereum consume energy at a rate akin to Guatemala.

Some environmentally-conscious artists have taken issue with this, directly linking blockchain’s energy consumption to carbon emissions. Artists like Memo Akten and Joanie Lemercier have canceled their NFT drops due to energy concerns and instead dedicated resources to making their ecological impact known.

NFT proponents have said that likening the energy consumption known as proofs of work (PoWs) to emissions is flawed, maintaining that most of the energy comes from clean sources. Still, the tech world has a tendency to develop technology rapidly with little time to gauge or consider the impact.

Akten and Lemercier have broadcast a few recommendations for CryptoArt and NFT platforms moving forward, including transparency with artists and a detailed path forward to limit consumption. Their pleas must be heard, dog-eared among the headlines of tech CEOs tokenizing their tweets for a profit and rappers releasing their audio sex-tapes as NFTs (things are really getting out of hand).

The explosion of interest in NFTs is exciting and unlocks a great potential, but it is advisable to step back and certify that it is environmentally-conscious before more than just a Banksy print goes up in flames. Despite the recent frenzy leading some to condemn NFTs as a craze, it is more than likely that they are here to stay and the ecological concern must be addressed.