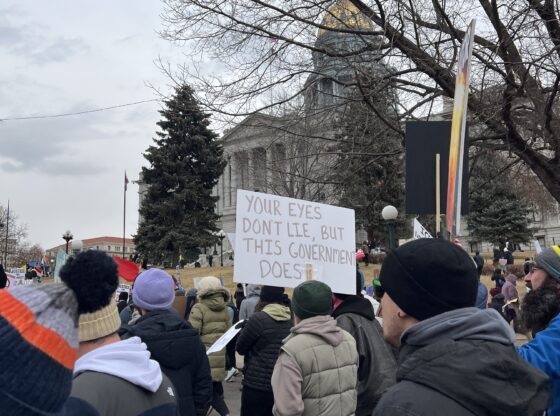

On Feb. 15, 2019, President Donald Trump signed the 2019 fiscal year budget. Many of his supporters are frustrated with not enough funding being dedicated to the border wall, while many of his opponents are frustrated with education and welfare cuts. Both sides, however, seem to agree on one thing: the deficit. For yet another year, the U.S. is spending more than it brings in in revenue. The new budget adds $984 billion to the national debt, which is $22.703 trillion (108.1 percent of the U.S. GDP). This is a $151 billion increase in spending from last year’s budget. If the U.S. wants to stay as a functioning government, then it must cut spending. Military spending is by far the U.S.’s greatest discretionary expenditure with what will be $597.1 billion, which is a $73.9 billion increase from last year. If the U.S. is going to survive, it needs to seriously consider cutting back on military spending. Defense spending, however, is not alone in the cuts that are needed to put the U.S. back on track. Mandatory spending on big programs such as Social Security, Medicare and Medicaid also need a reduction. These areas mark the U.S.’s largest mandatory expenditures, and if we continue to overspend in these sectors, the consequences will be dire. As the interest on our loans slowly increases over the years, the U.S. could find itself in a situation like Greece’s except without an EU to bail us out. The debt crisis argument is a battle between instant gratification and future prosperity.

Security is something that is very dear to the hearts of Americans. The U.S. has the largest defense budget in the entire world, and if you exclude Russia and China, that budget is greater than the combined budget of all other countries. The U.S., however, cannot realistically keep this overly large budget going. If the U.S. is going to eliminate the deficit and began to pay back its $22.703 trillion debt, then it must decrease not increase the defense budget.

Speaking of decreases, the $2.59 trillion in mandatory spending needs to be looked at. The majority of this comes from Social Security, Medicare and Medicaid. Social Security takes up the largest chunk, with $987 billion being dedicated to it. Since mandatory spending is required by law, it will be much more difficult to decrease this large expenditure, but it must be done if the U.S. is going to operate in the future. Cuts in these areas will obviously be very unpopular, but the people must understand that the government should not be spending money that it does not have.

Spending money that the government does not have has become a trend that will soon have dire consequences. By 2034, it is projected that Social Security benefits will need to be slashed by 21 percent or payroll taxes will need to be raised by 31 percent to keep the program alive. Interest payments on the debt are expected to reach $915 billion by 2028. This means that our budget will consist mostly of interest payments instead of defense and mandatory spending. The government would have to make extreme cuts along with large tax increases. In an extreme case, the government may even need to default on its loans, which would mean rapid devaluation of the dollar and a complete economic breakdown. The economic ramifications would likely create a global crisis with a magnitude that would make the Great Depression look like a minor recession. That, however, is an extreme case. If the U.S. wants to have a sustainable future, then it must make some hard and unpopular decisions.