Of all of the life steps that can be difficult for college kids to envision in their futures, homeownership is one of the more elusive and stress-inducing ones. With minimal current income, knowledge of high rents in most urban areas like Denver and no concrete careers as of yet, the prospect of affording to buy a home in the next ten years seems an implausible one. A lot of this fear is justified—only 37 percent of millennials owned homes in 2015. But as negative as our generation’s outlook on homeownership is, there are a lot of dynamics at play here. Where our generation chooses to move and how we disperse as we exit college will have a large influence on what homeownership looks like for us.

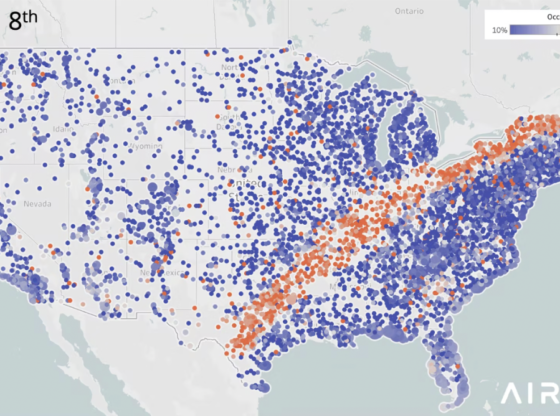

There are plenty of factors behind low rates of millennial homeownership, major ones including student debt that hinders ability to pay for housing as well as high rents in cities in general. Another more recent trend in the last decades is what economists have come to call “the Great Divergence.” CityLab analyzed this concept, showing how high-skilled jobs are pulling people to high-cost cities—highly-paid “knowledge workers” and lower-paid “service workers” are sorting into different cities and geographies in ways that didn’t used to happen. This is also intensified by the wide range of housing costs by state—lower-skill workers use more of their income on housing relative to higher-skill workers and therefore choose to live where there are lower housing costs.

But another interesting dynamic is at work that could signal some hope yet for young people pessimistic about homeownership: movement to the U.S.’s mid-size cities is on the rise, and a lot of these cities are making comebacks. Writing for CityLab, Oklahoma City’s longtime mayor Mick Cornett describes smaller yet growing metro areas—growth rates are strong in places like Fort Collins, Buffalo and Boise, and thousands of people are moving to these places from other, larger metro areas. Affordability is a major reason for this—Cornett cites the fact that with digitalization of work, it is becoming more realistic for highly-skilled workers to live in midsize cities instead of major ones and afford housing they could not otherwise.

Moving to a mid-size city does not sound glamorous to recent college graduates just launching their careers, but the option is an interesting one. In many ways, Denver is a city that has risen in attractiveness to young professionals in the last decades, and that will happen in other cities, too. It is important not to forget the problems this urban “revitalization” can cause—gentrification, income segregation and congestion are huge challenges that face growing cities, not to mention upward rent trends with more people moving in. But homeownership remains an important way to build wealth for people of all incomes, so it is important for that to be an achievable goal.

Affordability of housing and prospects for homebuyers are exceedingly complex dynamics. College kids are nervous for a reason when thinking about future housing, especially given student loans owed and limited income, but it may help to expand our consideration to more areas of the country when planning future moves. Living comfortably in New York or San Francisco may be out of reach, but every community has a lot to offer. How we think about homeownership will change as we include more places in our vision of where we want to live and work.