The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks/funds/bonds mentioned. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. Investments in stock markets carry significant risk, stock prices can rise or fall without any understandable or fundamental reasons. The Clarion does not recommend that anyone act upon any investment information without first consulting a financial advisor.

During the next two weeks, investors will be holding their breath as Twitter begins its final preparations before launching its initial public offering (IPO) on Nov. 6 on the New York Stock Exchange. Many skeptics are worried that Twitter will endure the same fate as preceding technology giants, such as Facebook (NASDAQ: FB) and Groupon (NASDAQ: GRPN), which both suffered major losses following their IPOs. Nonetheless, Twitter is demonstrating a level of maturity and transparency to its investors that makes this company an enticing buy.

With its IPO set at the modest price range of $17-$20 per share, Twitter is valued at a maximum of $14 billion or 27 times its annual sales revenue. Comparably, Facebook, which launched its IPO back in May 2012, was valued at 107 times its annual sales revenue and quickly saw its share price tank. Twitter’s modest pricing makes its stock look much more attractive.

Also, Twitter’s insider executives are not selling their shares, which is exactly what the Facebook insiders did last year because they had no confidence in the company. With projections of 3.5 billion Internet and 3.7 billion mobile users by 2017, Twitter IPO prospects could be very rewarding.

However, in the next 10 days, Twitter may no longer exist.

Because Twitter is still unprofitable and losses have tripled over the last fiscal year, several investors are hesitant about investing in the company. Additionally, user growth is down significantly and revenue per user (RPU) is less than half of that of Facebook’s.

Even though Twitter has avoided the IPO overhype and exhibited transparency by communicating all of the risks the company faces to its investors, it still has a high potential to follow in the steps of the Facebook flop.

Fortunately, this disastrous scenario can be mitigated through one power move. What if Google bought out Twitter?

Rumors have surfaced, once again, that Google may make an offer to purchase Twitter. Back in 2010, Google executives proposed the idea, but instead pursued the Google+ route that has unquestionably failed.

Even though the user metrics rank Google+ as the number two social media platform, the numbers are juiced. In order to identify yourself on Google, you have to sign into a Google+ account, and thus, the platform is inevitably forced upon all Google users. The online activity metrics support this assumption as Facebook, Twitter and Instagram are far ahead of Google+ in the daily activity rankings.

With a crumbling social media platform, Google needs to take the bull by the horns and buy out Twitter soon, much like it did with YouTube in 2006.

Google has over $15 billion in cash reserves and generates roughly $15 billion in revenue every fiscal quarter. With its share price breaking $1,000 last week, Google has the means to purchase a company that is valued at $14 billion.

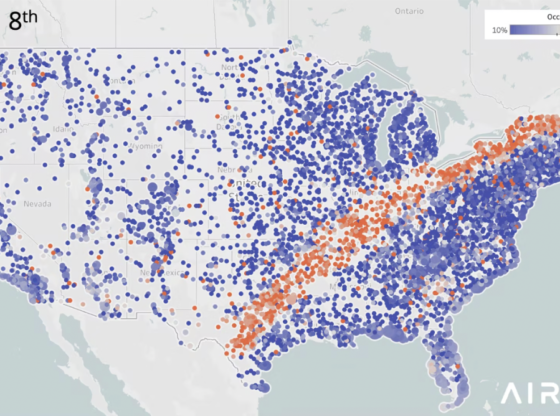

Currently, Twitter only can only target users and generate data from keywords in tweets and follower lists. Location services have yet to be implemented and more personalized webpages have yet to be rolled out. Compared to Facebook, Twitter knows so little about its users.

Imagine the ad targeting potential of Twitter’s platform backed by Google’s seemingly endless trove of user data and search histories. The company will automatically become more valuable, and its risk of failure will decrease dramatically.

And best of all, Google’s share price will continue to multiply.

ROD’S 5 STOCKS TO WATCH:

Apple Inc.

(NASDAQ: AAPL)

United Parcel Service, Inc.

(NYSE: UPS)

Newell Rubbermaid Inc.

(NYSE: NWL)

National-Oilwell Varco Inc.

(NYSE: NOV)

Callaway Golf Co.

(NYSE: ELY)