We are all addicted to it: shopping online for books and other products at deep discounts. But the savings do not end there, since most online retailers do not charge their customers sales tax. Even though shoppers do not want to hear it, taxing online transactions is long overdue.

How did our current tax-free system come into being? A 1992 Supreme Court decision cited the complications of assessing an online sales tax because the hundreds of different jurisdictions across the country, each with their own tax rates, would make it nearly impossible for online retailers to charge the correct tax rate. The Court also made this exemption because it was trying to give the upstarting e-commerce business a leg up in competing with established retailers.

Two decades later, both of these issues have been resolved. Customers inputting their zip code will easily match them to the correct tax rate in their jurisdiction, and the booming world of Internet commerce no longer needs a built in advantage over brick and mortar retailers.

As commerce increasingly moves out of stores and onto the Internet, brick and mortar retailers are having trouble competing with massive online retailers like Amazon. This exemption from taxes only widens the disparity. Local and state governments are also hurting as they lose millions of dollars of revenue per year to untaxed online sales. This is money that is no longer flowing to fund schools, libraries, park districts, law enforcement and other government services.

A little-known fact is that customers should theoretically pay state sales tax for the products they buy online by writing the dollar amount of goods purchased as a line item on their state income tax returns.

In reality, very few fill in this line item. For tax to be assessed at checkout online, the business must have a physical presence in the state. In reality, this means that Target and Walmart online purchases are taxed in every state, while Amazon can minimize its taxation by limiting its presence to a few states.

When states have attempted to use affiliate marketers who work with online retailers to justify a physical presence and thus collect taxes, it has failed miserably. In the nine states where legislation has passed, an immediate severing of all ties between online retailers and affiliate marketers resulted to eliminate tax responsibilities.

So what can be done to collect these taxes? Since retailers and affiliates are free to move across state lines to avoid potential taxation, change has to be made on the federal level.

I propose that the federal government temporarily enact a flat 5 percent tax across the board on all online purchases in all states where a state tax is not already assessed. This would temporarily bring some much needed revenue to Washington.

However, as soon as states understood that it was in their own best interest to tax online retailers via their own state sales tax, the federal tax would be eliminated in that state. It is a very circuitous way to implement this tax to say the least, but the only viable one as long as online retailers and affiliates are allowed to take tax refuge in other states.

I admit that an online sales taxes is not something most citizens and college students would be enthusiastic about.

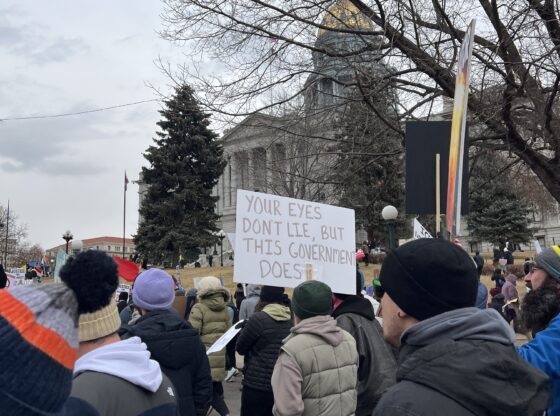

But please consider this: Is there any good reason why the same book should be taxed if you buy it downtown at The Tattered Cover but untaxed if you buy it online? The answer is no, it shouldn’t be.

On a $20 book purchase, a 5 percent tax rate would only come out to be an extra dollar, and a dollar will not break the bank, even for a broke college student.