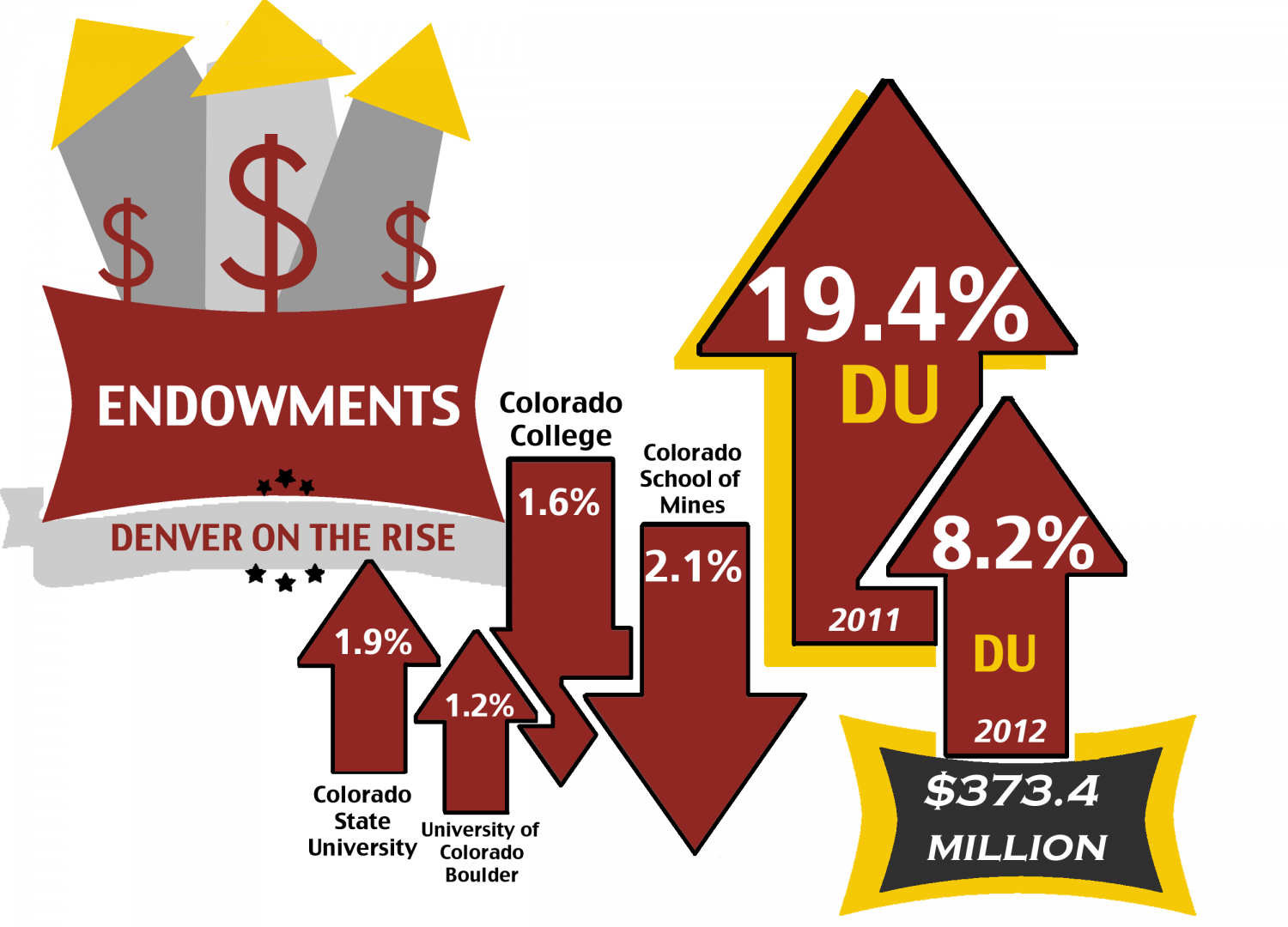

In 2012, DU saw its endowment increase by 8.2 percent to a value of $373.4 million. Last year, endowments were valued at $345 million, a rise of 19.4 percent from the previous year at $288 million. DU showed the highest percentage increase of all Colorado schools in endowment funds.

DU was ranked 186 out of 831 schools nationwide in endowment rates by the National Association of College and University Business Officers in a study released earlier this month.

The study ranked colleges based on the size of their endowments by comparing over 830 participating schools nationwide. The study accounted for increases in new gifts and performance on current investments according to Margaret Henry, Assistant Treasurer and University Comptroller.

Endowments are donations made by alumni and friends of the university that are designated to the school in forms of scholarships, faculty chairs, research programs and other avenues. There are also dues designated to the construction of the library, the Arts and Humanities Department, athletic and other departments.

According to Henry, endowment donations can vary greatly in size, but many are $50,000. She said DU has accrued over 600 endowment funds.

Henry attributed the rise in endowment rates to several practices of the university.

She said the numbers can partially be attributed to the university’s return on investments, which she said was 2.6 percent in 2012.

“We had a positive return last year, and a lot of universities had flat or negative returns,” she said. The positive return came from performance by real estate owned by the university, a practice which she said is uncommon for other schools.

Henry said another likely reason for the positive growth this year is because of a unique matching program instituted several years ago. The program allows for DU to match endowment donations designated for graduate and undergraduate scholarships to the university, which adds to the overall endowment rate.

Henry said the program has so far allowed for the university to match for $35 million in funds since its implementation.

“Part of the reason we do that is to incentivize donors into our campaign and to restrict them to graduate and undergraduate scholarships,” said Henry.

Henry also said the university has been helped by donations of “new gifts,” which accounted for $23.6 million last year.

DU was one of few schools to report a raise in endowment funds this year. According to the study, many schools saw decreased donations or increases of 1 – 2 percent.

Henry said performance has been helped by what she called a “conservative” investment style, allowing DU to hold many of the investments received in cash, a technique that became more valuable after the 2008 recession, which many universities are still struggling to recover from.

Henry said the program uses a spending formula which designates 4.5 percent of funds from each endowment to be spent on its designated purpose. The rest is saved for future use. She said this is a calculated formula based on endowment market value from the past 12 fiscal quarters.

“Our endowment is probably always going to lag the market indicators, but it will hopefully be better when there are down markets,” Henry said of the strategy. She said this meant that DU would likely be able to report rises in rates more frequently, but they may not always reflect the strength of the market at that time. Overall, however, the strategy would keep increases positive even in market downturns.

The University of Colorado Foundation, comprising of CU Boulder and CU Denver, saw the highest endowments of any Colorado school, with $771.3 million. However, this was only a 1.2 percent increase over last year.

Colorado College received $533.2 million, earning a rank of 140 on the list, and saw a decrease of 1.6 percent. The Colorado School of Mines also saw a decrease of 2.1 percent down to $204 million, and the Colorado State University Foundation saw a 1.9 percent rise to a $373.4 million value.