For many, the choice to attend college is a financial decision. Students must weigh the possible benefits of a college degree against the amount of debt their education will cost them. Many college students must ask themselves the following: “Is it worth it?”

Kesiah M., a freshman at DU, is one of many students who had to make this difficult decision. Luckily, she was granted a near full ride due to her demonstrated financial need.

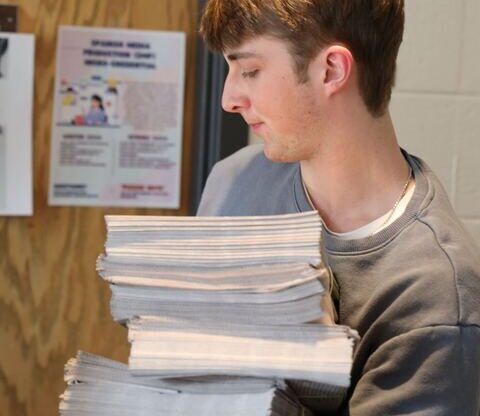

The process of gaining need-based financial aid is rather difficult. A student must submit both the FAFSA and the CSS profile by the end of February. After the basic forms have been filed, students must provide several additional forms, including the Household Confirmation Form, tax forms and W2s, and, for students of divorced or separated parents, the Non-Custodial Form. Unfortunately, it can sometimes take several months of paperwork and frustration to receive a financial aid award. Every form that is filed is then analyzed by the financial aid department to determine if a student has any demonstrated need and how much of that demonstrated need DU will cover.

After Kesiah submitted all of her financial aid forms, she waited, hoping that DU would provide her with enough aid to make attending the university possible. Eventually, Kesiah got a package in the mail that contained her financial aid award, and she is now able to attend DU while only having to take out a few thousand dollars in federal loans.

In many ways, Kesiah’s case is very simple. Her family is classified as low income, she has a younger brother who will be attending school soon, and her family has no assets. This makes her financial aid process easier than others. So, while the process worked in Kesiah’s favor, it often proves useless for others.

For one DU student, who wishes to remain anonymous, this process was stressful and unhelpful. The individual received no financial aid and was forced to take out over $30,000 in federal and private student loans. Much like Kesiah, this student can not afford a college education; however, their parents are divorced, they are the youngest child (and last to attend college) and their parents have a house that has been on the market for almost ten years. These combined attributes illustrate that the student will receive financial assistance from at least two parents, the parents can afford to send their last child to school and that the parents have assets rather than a financial burden.

It should be stated that it is a national norm to assume that a student’s parents will be at least assisting the student with paying for college. This outdated idea leaves many students, like our anonymous freshman, stuck between a mountain of debt and a future in a falling job market.

DU does almost nothing to help these students. These students may receive merit based aid, but due to the academic success required for these awards, it can be attributed not to the success of the financial aid department, but rather to the success of the student in high school. It should also be stated that the failings of the financial aid department are not attributed to outright negligence, but moreso a lack of funding and an extremely outdated system.

So, to answer the question at hand: does DU do enough to help low income families? No.

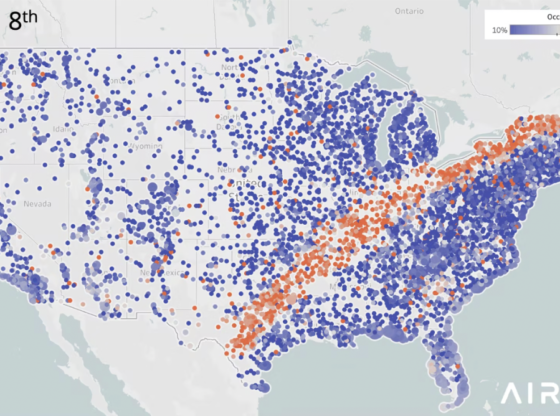

Luckily, the Office of Financial Aid knows that there is much more work to be done. According to John Gudvangen, Assistant Vice Chancellor and Director of Financial Aid, administrators are working hard to open financial aid to more students. To achieve this goal, they have created and started implementing the DU Impact 2025 Plan. This document claims that one of DU’s objectives is to “Expand financial aid to help recruit a more geographically and socioeconomically diverse international student body at the undergraduate, graduate and professional levels.”

Only time will tell if DU is able to implement these new financial aid goals. By 2025, the majority of low income students may be getting the aid they need, but, in the here and now, DU isn’t doing nearly enough to help the students in need aid of today.