Earlier this month, oil dropped below $50 a barrel for the first time since 2009. We’re paying significantly less at the gas pump, we have more disposable income, and those “greedy” Big Oil companies are no longer raking in record quarterly profits.

Sounds good, right? Well, not exactly. In fact, the more oil decreases in price, the more damage we will see throughout our economy and everyday lives.

Economic and hedge fund analysts are claiming that the drop in oil prices is the equivalent to a U.S. tax break of $100-125 billion. Because we are paying so much less at the gas pump, this extra money translates to higher consumption in other areas, such as retail spending.

Some analysts are going so far as to predict that these lower oil prices are going to boost U.S. GDP by at least half a percent in 2015. Morgan Stanley even said last month that cheaper fuel is an overall net benefit for the U.S. economy.

Early last year, the Manhattan Institute for Policy Research published a report on small businesses and energy employment. According to the report, America’s oil and gas boom has added $300-400 billion annually to the economy in recent years. Without such growth, U.S. GDP would have remained negative, and we would be entering our seventh consecutive year of recession.

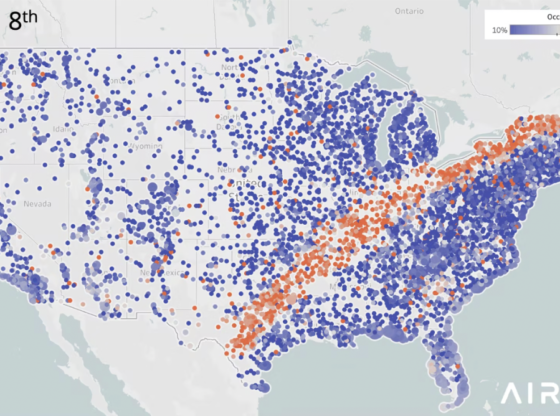

The report also stated that the shale oil and gas revolution has been the nation’s largest-single creator of stable, middle-class jobs throughout the U.S. economy as a whole. Currently, nearly one million Americans are directly employed in oil and gas, and over 10 million jobs are associated with the industry. Across the U.S., 16 states have over 150,000 jobs directly in oil and gas.

Lastly, the report stated, the oil and gas industry has overwhelmingly outperformed all other employment sectors. Since the beginning of the recession at the end of 2007, oil and gas has seen upwards of 40 percent job growth, while all other non-farm jobs have seen negative growth.

What we can conclude from these statistics is that “without new energy production, post-recession US growth would have looked more like Europe’s — tepid, to say the least. Job growth would have barely budged over the last five years,” observes Mark Mills, the author of the Manhattan Institute report.

Energy production in the United States has undoubtedly been the main driver in the economy for the last five years, and now we are in the midst of a completely different scenario. Energy-related output will not grow this year and will likely drop substantially.

Are lower oil prices making everyone better off? Will lower oil prices stimulate U.S. GDP because we are saving more at the pump? No.

Since the beginning of the Great Recession in December 2007, shale states have added over 1.36 million jobs.

These jobs fall into the “breadwinner” category jobs that many believe provide the basis for supporting a family.

With no new energy sector jobs being created, the steady rise we have seen in the “breadwinner” economy will plateau and most likely drop, even though the unemployment rate will continue to decrease (more cobblers).

Tying all of this information together, we can now draw a few troubling deductions. As long as oil continues to remain below $60/barrel, new well permits and the oil rig count will continue to drop. Employment associated with energy production will undoubtedly fall, but nevertheless, some positive effects will still emerge. Some businesses that use natural gas as an input, such as chemical companies, will benefit from lower oil prices. However, I cannot think of a substitute that could replace the jobs, GDP, and the 40% of total capital expenditure growth that the energy sector has recently produced. Millions of jobs are now on the table as drillers begin to cut back energy production.

Welcome to the crude awakening of 2015.